In the United States, the time it takes to close a mortgage can vary depending on a number of factors, including the type of loan, the lender, and the borrower’s financial situation. On average, it can take anywhere from 30 to 45 days to close a mortgage. However, some lenders may be able to close a mortgage in as little as two weeks, while others may take longer.

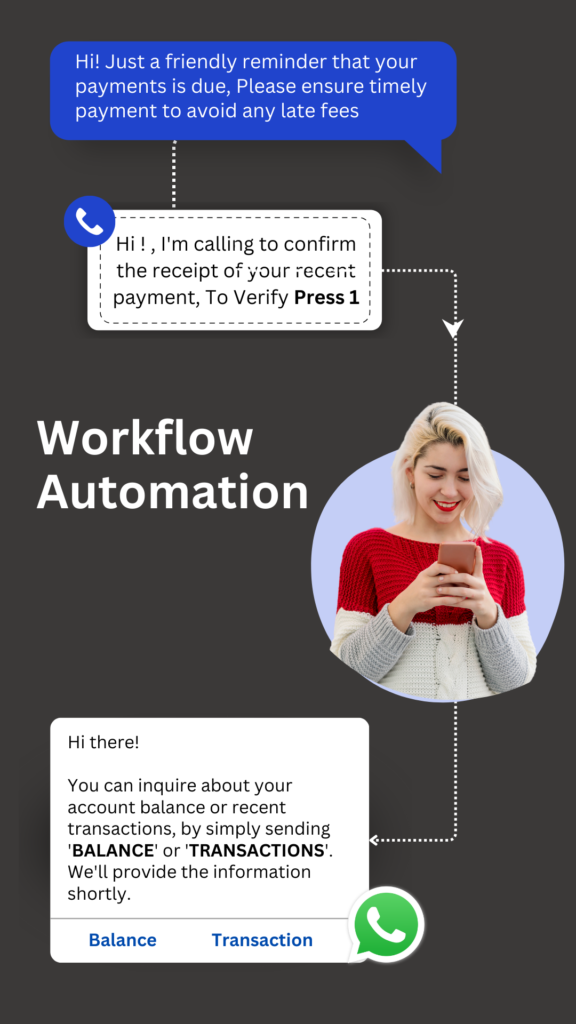

Texting can help speed up the mortgage closing process by providing a quick and convenient way for borrowers and lenders to communicate and exchange important information. For example, a borrower can use text messages to quickly provide the lender with any documentation or information that is needed to complete the loan application. The lender can then use text messages to update the borrower on the status of the loan and to provide any instructions or information that is needed to move the process forward.

Overall, texting can help streamline the mortgage closing process by providing a faster and more efficient way for borrowers and lenders to communicate and collaborate. This can help ensure that the closing is completed as quickly and smoothly as possible.

Here are tips to get more applications processed with texting-

- Personalize your messages to each individual borrower to make them feel valued and understood.

- Use clear and concise language to convey important information and avoid confusion.

- Include a call to action in each message to encourage borrowers to take the next step in the mortgage application process.

- Offer assistance and support to help borrowers overcome any obstacles or challenges they may be facing.

- Provide regular updates and progress reports to keep borrowers informed and engaged.

- Use a professional and friendly tone to build trust and establish a positive relationship with borrowers.

- Use data and analytics to target your messaging and tailor it to the specific needs and preferences of each borrower.

- Leverage technology, such as automation and personalized URLs, to streamline the mortgage application process and make it easier for borrowers.

- Stay compliant with all relevant regulations, including those related to data privacy and consumer protection.

- Keep track of your results and constantly optimize your messaging strategy based on what is working and what isn’t.